Accumulated depreciation formula balance sheet

They provide actionable insights on various aspects of the business and help you make confident business decisions. Imagine that we are tasked with building a 3-statement statement model for Apple.

Depreciation Expense Double Entry Bookkeeping

What are Different Types of Depreciation.

. Assets Liabilities Equity. The formula for net book value is cost an asset minus. Balance Sheet Essentials.

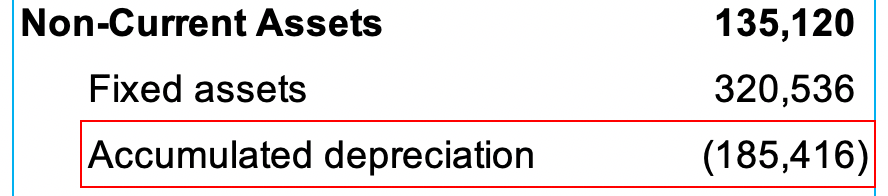

Accumulated depreciation is the cumulative depreciation of an asset up to a single point in its life. A companys balance sheet represents its financial health and position of it at a given time. Accumulated depreciation is the contra asset account Contra Asset Account A contra asset account is an asset account with a credit balance related to one of the assets with a debit balance.

The salvage value is Rs. Business reports play a vital role in regularly tracking and measuring a companys financial performance. Double declining balance is calculated using this formula.

This will also be recorded as accumulated depreciation on the balance sheet. Common current assets includes cash cash coin balances in checking and savings accounts accounts receivable amounts owed to your business by your. However the classified balance sheet focuses on representing the assets and liabilities in.

It can also be referred to as a statement of net worth or a statement of financial position. Accumulated depreciation on 31 December 2019 is equal to the opening balance amount of USD400000 plus depreciation charge during the year amount USD40000. The purpose of a balance sheet.

Read more ie an asset account having the credit. Accumulated depreciation is used to calculate an assets net book value which is the value of an asset carried on the balance sheet. On April 1 2012 company X purchased a piece of equipment for Rs.

Company X considers depreciation expenses for the nearest whole month. Investors business owners and accountants can use this information to give a book value to the business but it can be used for so much more. Based on analyst research and management guidance we have completed the companys income statement projections including revenues operating expenses interest expense and taxes all the way down to the companys net income.

Cr_Accumulated depreciation 40000 BS Total accumulated depreciation expenses at the end of 31 December 2019 is USD440000. Operating income Gross Profit Operating Expenses Depreciation Amortization. The balance sheet displays the companys total assets and how the assets are financed either through either debt or equity.

Amortization is used for calculating drop in value for intangible assets. There are three formulas to calculate income from operations. This is expected to have 5 useful life years.

Operating income Total Revenue Direct Costs Indirect Costs. While there are various methods to calculate depreciation three of them are more commonly used. The balance sheet is based on the fundamental equation.

Assets Liabilities Owners Equity. There are different types of business reports such as accounting reports and registers inventory reports and statements reports related to finance. The balance sheet formula is the accounting equation and it is the fundamental and most basic part of the accounting.

Now let discuss how to calculate accumulated depreciation. Also included is canceled currency held pending destruction and currency destroyed in late shift work on the balance sheet date. The balance sheet will form the building blocks for the whole double entry accounting system.

Balance sheet projections exercise. It represents the assets owned by a business entity liabilities owed and the businesss equity. Finally the formula for depreciation can be derived by dividing the difference between the asset cost step 1 and the accumulated depreciation step 8 by the useful life of the asset step 3 which is then multiplied by 2 as shown below.

Accumulated depreciation is. 2 x basic depreciation rate x book value. Accumulated depreciation is the total depreciation of the fixed asset accumulated up to a specified time.

When we add the balances of these two assets we will get the net book value or carrying value of the assets having a debit balance. Your basic depreciation rate is the rate at which an asset depreciates using the straight line method. Examples of Balance Sheet Formula With Excel Template Balance Sheet Formula Calculator.

Operating income Net Earnings Interest Expense Taxes. CFIs Financial Analysis Course. Cost of the asset recovery period.

Because the balance sheet reflects every transaction since your company started it reveals your businesss overall financial health. The term current in a balance sheet generally means short-term which is usually one year or less. The declining value of the asset on the balance sheet is reflected on the income statement as a depreciation expense.

Formula for Operating income. Generally a balance sheet is presently based on the accounting equation. Fixed Assets In The.

To get that first calculate. The latter are determined by formula when credit is being taken for unfit currency that is destroyed and appropriate adjustment is made to Treasury general account. So the accumulated depreciation for year 1 is 10000.

How Accumulated Depreciation Works. Figure out the assets accumulated depreciation at the end of the last reporting period. Using the formula for accumulated depreciation the calculation for year 2 with the values filled in is.

An assets carrying value on the balance sheet is the difference between its purchase price. The double declining balance formula. 1026 Federal Reserve NotesIn Transit 210-075.

Depreciation Expense Depreciation Expense Accountingcoach

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Definition Formula Calculation

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Accumulated Depreciation Definition Formula Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

How Is Accumulated Depreciation Represented In The Balance Sheet As A Negative Credit Asset Or As A Positive Debit Liability Quora

What Is Accumulated Depreciation How It Works And Why You Need It

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-02-b230b73e49c3406ba7b944172f09a624.jpg)

Why Is Accumulated Depreciation A Credit Balance

Straight Line Depreciation Accountingcoach

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Overview How It Works Example

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Accumulated Depreciation Explained Bench Accounting

Depreciation Formula Examples With Excel Template

Accumulated Depreciation Calculation Journal Entry Accountinguide

Accumulated Depreciation Definition And Why It Is Important Fincent